Deriv provides a selection of 8 trading platforms, each tailored to suit different trading styles and preferences. These platforms boast a wide array of features and tools meticulously crafted to accommodate various trading strategies, offering advanced charting capabilities, technical analysis indicators, and customizable layouts.

Designed with user-friendliness in mind, all platforms cater to both novice and seasoned traders alike. They ensure effortless access to a diverse range of financial markets, spanning forex, stocks, indices, ETFs, cryptocurrencies, and commodities.

Company Details

The enhanced Deriv platform not only presents an extended range of products but also delivers an enhanced user interface, complemented by a revamped logo.

In a gradual transition, a collective of traders engaging in 43 million monthly trades and conducting $6 million in monthly withdrawals seamlessly migrated to Deriv.com.

Since its rebranding, the global brokerage has witnessed substantial growth. Deriv now boasts a user base exceeding 2.5 million traders, contributing to a total trading turnover surpassing $10 billion. The platform facilitates over 26 million monthly withdrawals and executes more than 114 million trades per month. This distinguished trading firm, which has received accolades, employs over 1000 professionals across 18 locations, including Cyprus and Dubai.

Operational under regulation in numerous trading jurisdictions, Deriv.com holds licenses from the Malta Financial Services Authority, Labuan Financial Services Authority, Vanuatu Financial Services Commission, and the British Virgin Islands Financial Services Commission.

Deriv Regulations

Deriv operates under the regulation of five entities:

- Deriv (V) Ltd, regulated by the Vanuatu Financial Services Commission (VFSC), which we classify as a Tier 3 regulator.

- Deriv (BVI) Ltd, regulated by the British Virgin Islands Financial Services Commission (BVI FSC), which we also rate as a Tier 3 regulator.

- Deriv (FX) Ltd, regulated by the Labuan Financial Services Authority (LFSA) in Malaysia, categorized as a Tier 2 regulator in our assessment.

- Deriv Investments (Europe) Limited, regulated by the Malta Financial Services Authority (MFSA), similarly rated as a Tier 2 regulator.

- Deriv (SVG) LLC, an unregulated entity registered in St. Vincent and the Grenadines.

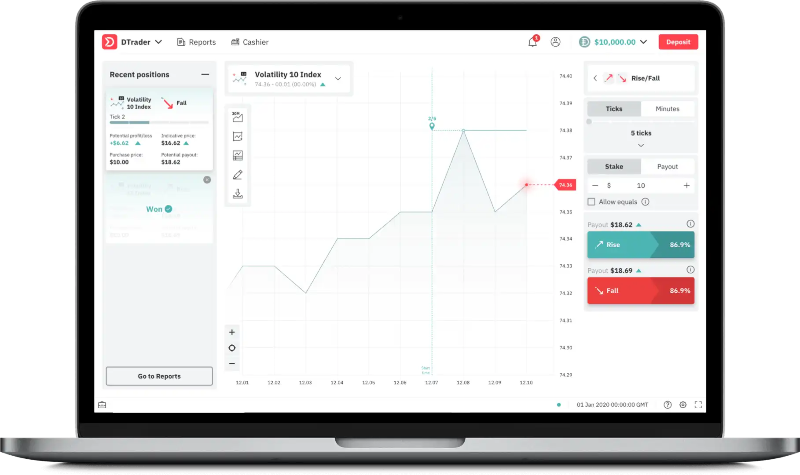

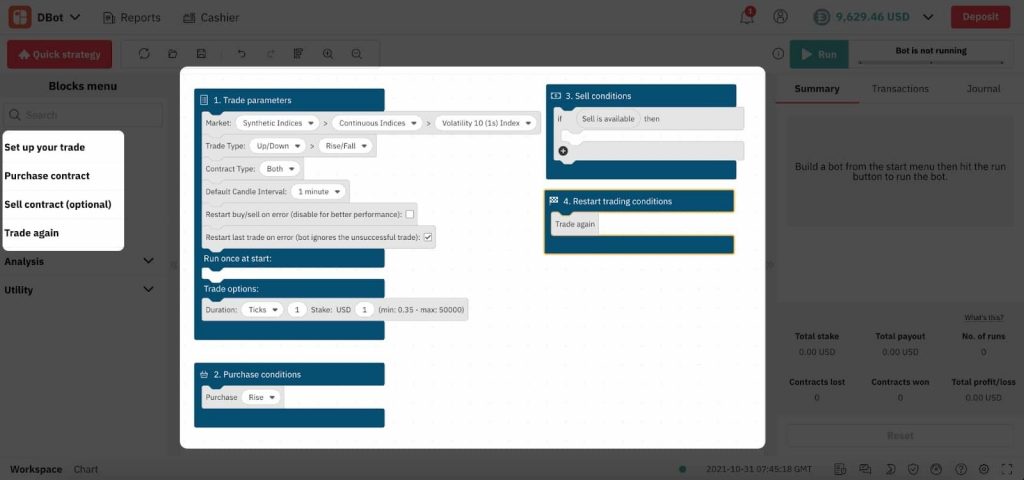

Deriv Platforms and Tools

Fees

Trading Fees Assessment:

Spread Analysis:

| Instrument | Live spread AM | Live spread PM |

| EURUSD | 0.5 | 0.6 |

| GBPJPY | 1.4 | 1.2 |

| Gold (XAUUSD) | 17 | 25 |

| WTI Oil | 0.06 | 0.06 |

| DAX | 1.4 | 1.7 |

| Dow Jones | 3.5 | 3.5 |

| Apple | n/a | 0.61 |

| Tesla | n/a | 1.15 |

| Bitcoin | 23.63 | 23.63 |

Spreads & Commissions

Deriv.com ensures traders benefit from competitive trading conditions marked by narrow spreads, commencing at 0.5 pips for major forex pairs like EUR/USD. A distinguishing feature is the absence of commission charges, deposit or withdrawal fees, and penalties for account dormancy.

Echoing the principles of Binary.com, Deriv.com maintains its legacy of offering competitive spreads and transparent fee structures.

Regarding leverage, Deriv grants traders the flexibility to select from various leverage options, extending up to 1:1000. This empowerment enables traders to open larger positions with a relatively small margin deposit, thereby magnifying potential profits.

It's important to recognize that margin requirements and leverage ratios may vary based on the account type and jurisdiction of registration. For instance, within the European Union, regulations impose a maximum leverage cap of 1:30 for major currency pairs on retail accounts, underscoring the platform's adherence to regulatory standards and commitment to fostering responsible trading practices.

Account Types

Deriv has designed a simplified one-stop account type called ‘Deriv’ that gives access to DTrader, SmartTrader, DBot, Binary Bot, and Deriv GO. That approach aims to ensure customers’ access to quite competitive trading conditions and the broker has already done a great job with its all-inclusive account to fit all traders of different sizes, risk profiles, and trading styles.

On top of that, Deriv offers a Demo Account loaded with virtual funds to give new traders the opportunity to put their skills to the test with no risk.

Deriv also offers a swap-free account that can be accessed through the Trader’s hub, and it is subject to the following conditions:

- It is specifically designed for MT5 accounts.

- It is open to ROW countries excluding the EU.

- It encompasses all synthetic assets except for Boom and Crash.

- It encompasses all financial assets, with the exception of Forex micro and Commodities.